I'm frequently surprised, more so during elections, at just how many Canadians jump on the anti-tax bandwagon with no real idea of how lower taxes will impact themselves and society as a whole. You can't just lower taxes and expect to receive the same level of service you received when paying higher taxes. But we don't want the same level of service, do we? No, we want more and better service, and all for a cheaper price. We want shorter wait times at hospitals and more family doctors, smaller class sizes and full-day kindergarten, better roads, more long-term care spaces for the elderly, better environmental stewardship, the list goes on and on. The problem is you can't get more for less, without sacrificing quality.

Here's how our federal tax dollars were spent in 2010:

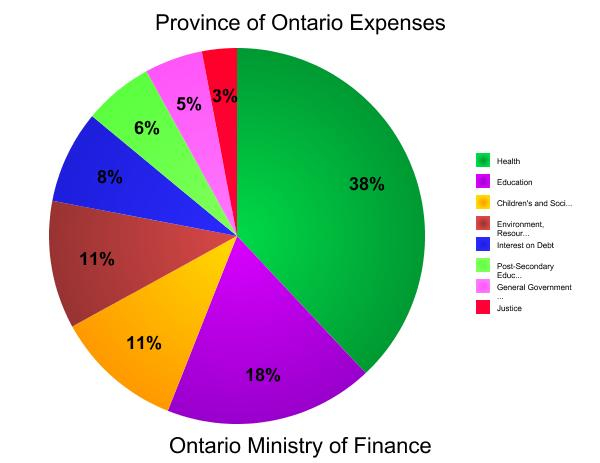

And our provincial tax dollars:

Both federally and provincially, income taxes are the biggest contributor to the tax base, followed by sales and corporate taxes.

One can argue that if taxes were spent more efficiently we could afford to lower them. As Rob Ford, the mayor of Toronto has wonderfully demonstrated, this "gravy" is very much non-existent. If Toronto, the wealthiest city in Ontario, can't cut spending without cutting services like libraries and police, it's doubtful than many other municipalities, if any at all, can find this so-called "gravy," either.

Statistics show that the George W. Bush era of tax cuts in the Untied States has contributed more to the country's debt than the economic downturn, recovery measures (bailouts and economic stimulus), and the war for oil (oops...I mean on terrorism). The fact that economists denounce the reduction of the GST in Canada (which voters support), and support the HST (which voters denounce) is truly worrisome and indicative that Canadians' attitudes toward taxes are beginning to mirror those of our neighbours to the south.

|

| Center on Budget and Policy Priorities, based on estimates from Congressional Budget Office |

Taxes are an investment in our future - in our children's and grandchildren's futures. Yet taxes have been continuously reduced in Canada for the past decade, while our provincial and federal deficits and debts soar. Health expenditures, as seen above, require the most funding from the tax base, and their share of the pie is only going to grow. Our society is aging, and our youth are experiencing more health problems now than they have in the past century. As health care costs consume more and more of our taxes, are we going to be willing to cut spending on education, justice, social programs, national security and sovereignty, and other essential services to keep up? I doubt it, but without a healthier tax base, that's precisely what will happen.

We need a better tax system. Corporations and the wealthy need to pay more. Carbon taxes should replace a good portion of income taxes. The GST needs to be returned to an appropriate level. The reduction of the GST (which reduces government revenue by over $13 billion a year) was nothing more than a bribe - one of Harper's many ways of buying votes. Any politician with half a brain knows that reducing sales taxes is not good economic policy. It's not only insulting, but it's downright deplorable that the Prime Minister of our country misleads Canadians and promotes political and economic ignorance by promoting flawed policies simply to improve his chances at election. Ask yourself this: who does sales tax reduction really help? It doesn't do much to help the average Canadian who can't afford to go shopping at the mall every week. A 2% reduction in sales tax does, however, mean a lot to an already under-income-taxed wealthy Canadian who can afford a $1000 pair of shoes and a $100 000 luxury sedan. Reductions in corporate and sales taxes help the rich more than the poor. Period.

|

| Best Buds |

Income disparity (the gap between the rich and the poor) is now growing more quickly in Canada than in the United States. While the average Canadian is very lucky to enjoy a better standard of living than the average American, as our social and economic policies continue to mimic American policies, our standard of living is quickly joining the Americans' in a race to the bottom.

According to Alex Himelfarb, Director of the Glendon School of Public and International Affairs, at York University, former Clerk of the Privy Council and Secretary to the Cabinet, "It is time to make some hard choices about the Canada we want, about what services we see as essential, about how much inequality we are prepared to tolerate, about our willingness to take back the future."

No comments:

Post a Comment